RESEARCH

My research studies how information frictions in financial markets arise from, and impact, managerial decisions and firm outcomes. I am particularly interested in understanding how capital market participants’ use and monitoring of corporate disclosure influence managers’ strategic disclosure and investment decisions. Corporate disclosure informs stakeholder decisions, thereby alleviating the information frictions they face. Yet disclosure—and, by extension, information frictions—are not exogenous. Managers strategically disclose information in anticipation of how the capital market will use and monitor it. As market participants understand managers’ disclosure incentives, they adjust the way they use and monitor disclosures. I investigate these interactions and their economic consequences through formal theory, reduced-form empirical analyses, and estimations of structural economic models. I focus on two themes: (1) firm stakeholders' usage of information as an implicit incentive that influences managerial decisions and firm outcomes, and (2) the role of the market for accounting services in firms' financial reporting choices. As an extension of the second theme, I also study institutional factors contributing to misreporting and agency problems.

INFORMATION PROCESSING AND DECISION-MAKING

The Dog that Did Not Bark: Limited Price Efficiency and Strategic Nondisclosure

with Yuqing Zhou, 2020

Journal of Accounting Research 58(1), 155-197

Theory posits that investors can rationally infer the implications of strategic nondisclosure for firm value, pressuring managers to disclose information voluntarily. This study documents that the lack of an earnings guidance predicts an abnormal return of−41 basis points around the subsequent quarterly earnings announcement, suggesting that investors do not fully incorporate the implications of nonguidance. Further analyses demonstrate that limitations in price efficiency, driven by investors’ limited attention and short-selling constraints, explain the mispricing of nonguidance and are associated with less guidance issuance. Our results collectively highlight limited price efficiency as another friction when studying managers’ strategic disclosure decisions.

.png)

FIG. 3.—Daily size-adjusted returns around the earnings announcement date. This figure presents daily size-adjusted returns from five trading days before the quarter q earnings announcement date to five trading days afterward. The x-axis is days relative to the current quarter’s earnings announcement. The y-axis is daily size-adjusted returns. The dotted line represents firm quarters without management guidance (of any type) from one day prior to the quarter q−1 earnings announcement and one day prior to the quarter q earnings announcement. The solid triangle line represents firm quarters with management earnings guidance from one day prior to the quarter q−1 earnings announcement and one day prior to the quarter q earnings announcement.

The Effect of Credit Ratings on Disclosure: Evidence from the Recalibration of Moody’s Municipal Ratings

with Jacquelyn Gillette and Delphine Samuels, 2020

Journal of Accounting Research 58 (3), 693-739

This paper examines how credit rating levels affect municipal debt issuers’ disclosure decisions. Using exogenous upgrades in credit rating levels caused by the recalibration of Moody’s municipal ratings scale in 2010, we find that upgraded municipalities significantly reduce their disclosure of required continuing financial information, relative to unaffected municipalities. Consistent with a reduction in debtholders’ demand for information driving these results, the reduction in disclosure is greater when municipal bonds are held by investors who relied more on disclosure ex ante. However, we also find that the reduction in disclosure does not manifest when issuers are monitored by underwriters with greater issuer-specific expertise and when issuers are subject to direct regulatory enforcement through the receipt of federal funding. Overall, our results suggest that higher credit rating levels lower investor demand for disclosure in the municipal market, and highlight the role of underwriters and direct regulatory enforcement in maintaining disclosure levels when investor demand is low.

.png)

FIG. 2.—Trends around the ratings recalibration. This figure presents differences in FinReporting and FinReporting Freq (panel A) between our treatment and control groups around Moody’s recalibration, relative to our benchmark reporting period (2009= Pre1), where each reporting period runs from July 1–June 30. The difference-in-differences coefficients in panel A are reported.

This paper examines whether investor learning about profitability (i.e., the mean of earnings distribution) leads to persistence in disclosure decisions. A repeated single-period model shows that persistent investor beliefs about profitability lead to persistent disclosure decisions. Using earnings forecast data, I structurally estimate the model and perform several counterfactual analyses. I find that, when investors are assumed to know profitability, the persistence of management forecast decisions significantly declines by 17%–27%. About 24% of firms would have disclosed differently, resulting in 3.9% net change in the amount of information (i.e., posterior variance) provided to the capital market. Collectively, the results indicate the importance of learning profitability in understanding disclosure decisions and the capital market consequences of disclosures.

.png)

Panel B examines the intertemporal correlation of forecast decisions for three cases. The first row represents the case in which investors do not know profitability and disclosure cost does not depend on the observed covariates. The second row corresponds to the case in which investors know profitability and the disclosure cost does not depend on the observed covariates. The third row examines the case in which investors know profitability and the disclosure cost depends on the observed covariates. Columns (1)–(4) report the intertemporal correlation of the forecast decisions, measured as the autoregressive coefficients of the current quarter’s forecast decision on each of the previous four quarters’ forecast decisions. The simulation is conditional on reported earnings and the covariates from the data and is performed 500 times for each case. The average is reported.

Disagreement about Fundamentals: Measurement and Consequences

with Paul Fischer and Chongho Kim, 2022

Review of Accounting Studies 27, 1423-1456

We propose a measure of disagreement, which reflects differences of opinion as opposed to information asymmetry, that can be extracted from sequences of analyst forecasts. Using a Bayesian theoretical framework, we prove that when analysts agree, a regression of an analyst’s forecast on the previous forecast issued by another analyst should have a slope coefficient of one. The magnitude of the estimated regression coefficient’s deviation from one is then employed as a disagreement measure. We validate the measure using tests tied to predicted relations between disagreement and trading volume and bid-ask spreads. Finally, we employ our measure to test for associations between disagreement and expected returns predicted by antecedent theoretical studies.

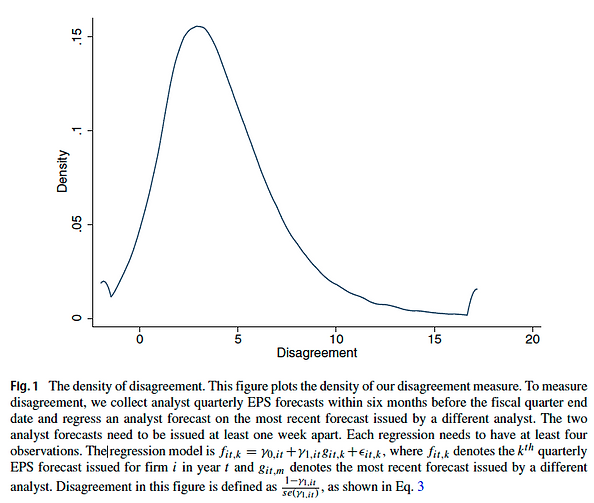

.png)

Financial Reporting and Employee Job Search

with Ed deHaan and Nan Li, 2023

Journal of Accounting Research 61(2), 571-617

We investigate the effects of financial reporting on current employee job search, that is, whether firms’ public financial reports cause their employees to reevaluate their jobs and consider leaving. We develop theory for why current employees use earnings announcements (EAs) to inform job search decisions, and empirically investigate job search based on employees’ activity on a popular job market website. We find that job search by current employees increases significantly during EA weeks, especially when employees are more mobile and when their information frictions are greater. We also find that employees use EAs to update their expectations about their employers’ economic prospects, consistent with learning, and some evidence that positive announcements elicit less search. Our paper contributes to the burgeoning labor and accounting literature by providing among the first evidence closely linking financial reports to employee learning and job search.

.png)

Fig. 2.—Review counts around earnings announcements (EAs). This figure plots the average weekly review counts relative to that of the EA week, where review counts are orthogonalized against firm-quarter fixed effects. A firm quarter must have at least 13 weeks to ensure that two adjacent quarters are comparable. The horizontal axis represents weeks relative to the EA week. The vertical axis represents average weekly review counts relative to that of the EA week.

Financial Reporting Quality and Myopic Investments: Theory and Evidence

with Heng (Griffin) Geng and Cheng Zhang, 2023

The Accounting Review 98(6), 223-251

We present theory and empirical evidence that greater financial reporting quality can incentivize myopic investments. In the model, greater financial reporting quality increases investor response to earnings, elevating the manager’s incentive to invest myopically to improve earnings. Using the setting of Big N auditors’ acquisitions of non-Big Ns, which increased investor response to earnings for the acquired client firms, we find evidence supporting myopic investments. Specifically, acquired clients decrease intangible investments, particularly when (1) the increase in investor response to earnings is larger and (2) the horizon of shareholders is shorter. The investment decrease is inefficient, as evidenced by reduced profitability, fewer exploratory innovations, and other measures.

.png)

This figure shows the evolution of intangible investments around Big Ns’ acquisitions of non-Big Ns. Depicted in the solid (dashed) line is the mean intangible investment of treated (control) client firms in k years relative to the completion year of audit firm acquisitions. The vertical lines around each dot represent the 90 percent confidence intervals for the mean estimates.

Signaling Long-term Information Using Short-Term Forecasts

with Mirko Heinle, Chongho Kim, and Daniel Taylor, 2025

Journal of Accounting and Economics, forthcoming

This paper shows theoretically and empirically that the decision to disclose a short-term earnings forecast can reveal managers’ private information about long-term performance. Consistent with the predictions of our model, we find that the decision to disclose a short-term earnings forecast predicts long-term performance for up to three years. The relation strengthens when current period performance is poor, when managers have longer horizons, and when competitive threats are lower. Endogenizing the proprietary costs of disclosure, our analysis suggests that––despite the short horizon––the decision to provide an earnings forecast contains significant information about long-term performance and thus can entail proprietary costs.

.png)

Strategic (Inconsistent) Disclosures and Sophisticated Investors: Evidence From Hedge Funds

with Yichang Liu and Joshua Madsen, 2025

Journal of Accounting Research, forthcoming

Recent SEC regulations require that qualified hedge fund advisers provide their investors with narrative disclosures of their business and operations. We find that 40% of these disclosures omit information regarding advisers' operational and investment risks when compared to other sources of public information. Funds with such ``inconsistencies'' are associated with predictably lower fund performance but do not differ in their fund flows, flow-performance relation, leverage, ownership structure, or management fees. These results are consistent with investors being subject to limited strategic thinking, which prevents them from fully unraveling the implications of strategic omissions. This, in turn, contributes to advisers' successful use of discretion to de-emphasize information with adverse performance implications. Our findings suggest that information processing frictions can facilitate non-disclosure, even in markets with sophisticated investors.

.png)

This figure plots the relation between Inconsistent:Any and fund performance by year for the sample period 2015--2018. The dependent variable is the Fung and Hsieh (2001, 2004) seven-factor alpha.

Asset Comovement and Competition for Price Efficiency: Theory and Evidence

with Cathy Schrand and Stella Park, 2025

The Wharton School of the University of Pennsylvania Working Paper

This paper provides theory and empirical evidence that the use of disclosure as a tool to increase price efficiency depends on the degree to which firms comove with other firms. Greater firm-sector comovement increases the cost for investors to distinguish firm-specific information from sector-wide information, reducing their expected trading profit and increasing the usefulness of disclosures. The model generates two predictions that are supported by data. As comovement increases, firms increase disclosures to compete for investors and improve price and investment efficiency. Disclosures create negative externalities from peer firms who are competing for the same investors, implying a lower improvement in investment efficiency as comovement increases. Our findings support a novel role for disclosures as a tool to compete for traders' information processing.

.png)

THE MARKET FOR ACCOUNTING SERVICES

Auditor Tenure and Misreporting: Evidence from a Dynamic Oligopoly Game

with Edwige Cheynel, 2024

Management Science 70(8),5557-5585

We estimate an infinite-horizon dynamic oligopoly model of audit firm tenure and misstatements and evaluate a policy counterfactual involving mandatory audit firm rotation. Longer tenure lowers the cost of producing audits, increasing audit quality and reducing audit fees. Thus clients are less likely to misstate and more likely to keep the incumbent audit firm as tenure increases. By reducing the value of retaining audit firms, mandatory rotation leads to large increases in auditor switches, even before the term limit, implying increases in the switching costs borne by clients. Misstatement rates increase because audit firms endogenously lower audit quality and newly hired audit firms have lower quality. Overall, the model suggests caution when evaluating the costs and benefits of government oversight over the audit profession.

.png)

(a) Five-year rotation. (b) Ten-year rotation. This figure plots the relation between tenure and the probability of switching under 5- and 10-year rotation rules in the left and right panels, respectively. The dash-triangle line represents the Big Four’s market share under mandatory audit firm rotation. The dotted-plus line represents the Big Four’s market share in the case of no client and audit firm reoptimization. The horizontal axis is audit firm tenure. The vertical axis is the Big Four’s market share. The figure excludes the rotation year in which the incumbent does not offer audit services.

Fraud Power Laws

with Edwige Cheynel and Davide Cianciaruso, 2024

Journal of Accounting Research 62(3), 833-876

Using misstatement data, we find that the distribution of detected fraud features a heavy tail. We propose a theoretical mechanism that explains such a relatively high frequency of extreme frauds. In our dynamic model, a manager manipulates earnings for personal gain. A monitor of uncertain quality can detect fraud and punish the manager. As the monitor fails to detect fraud, the manager’s posterior belief about the monitor’s effectiveness decreases. Over time, the manager’s learning leads to a slippery slope, in which the size of frauds grows steeply, and to a power law for detected fraud. Empirical analyses corroborate the slippery slope and the learning channel. As a policy implication, we establish that a higher detection intensity can increase fraud by enabling the manager to identify an ineffective monitor more quickly.

.png)

Fig. 1.—Empirical PDF and fitted power law PDF. This figure plots the estimated power law PDF for restatement amounts (solid line) against the empirical PDF (dashed line) based on 1,173 unique restatement events from Audit Analytics Restatement between 2005 and 2021. The restatement amount is the cumulative amount of misstatement of earnings for a restatement event. The sample consists of restatement events that likely correct intentional manipulations. These events are identified using (i) ex post measures, namely, fraud or external or internal investigations (i.e., Securities Exchange Commission [SEC] or board of director investigations) (Hennes, Leone, and Miller [2008]) and (ii) ex ante measures, namely, core account classifications (Palmrose, Richardson, and Scholz [2004], Zakolyukina [2018]). We further keep annual misstatements that increase net income and restatements for which the beginning total assets exceed $1 million. All restatement amounts are scaled by the total assets before the restatement beginning date.

The Impact of Regulatory Leniency on Compliance: Evidence from the Municipalities Continuing Disclosure Cooperation Initiative

with Mark Maffett and Delphine Samuels, 2025

The Accounting Review, forthcoming

We examine how the SEC’s 2014 Municipalities Continuing Disclosure Cooperation initiative (MCDC) affects disclosure compliance in the municipal bond market. The MCDC granted favorable settlement terms to municipal debt issuers and underwriters who voluntarily self-reported having violated SEC disclosure requirements. Although underwriters participated widely, most municipal issuers did not participate in the MCDC initiative despite having publicly observable disclosure violations. We find that, after the MCDC, official statements were less likely to contain false claims about past compliance—particularly when underwriters had participated—suggesting improved underwriter oversight of the initial bond offering. However, contrary to the SEC’s intention, we observe a 9 percent post-MCDC decrease in issuers’ compliance with continuing disclosure requirements compared with a control group of voluntarily disclosing issuers. Our findings provide no evidence that the MCDC improved continuing disclosure compliance; rather, the MCDC may have instead exacerbated noncompliance by exposing the weaknesses of the existing regulatory regime.

.png)

This figure reports coefficients and 95 percent confidence intervals for OLS regressions estimating the effect of the MCDC initiative on the likelihood of providing continuing disclosure for municipal bond issuers subject versus not subject to continuing disclosure requirements. Each reporting period runs from March through February (e.g., reporting period 2014/15 runs from March 1, 2014 through February 28, 2015).

Competition and Certification: Theory and Evidence From the Audit Market

with Heng (Griffin) Geng and Cheng Zhang, 2024

Review of Corporate Finance Studies, forthcoming

We study how financial certifier competition influences loan contracting in the context of financial auditing. Exploiting the unexpected demise of Arthur Andersen that exogenously decreased auditor competition, we find a greater decrease in loan spread for borrowers in markets in which certifier competition declined more. Additional analyses suggest the result stems from enhanced audit quality and reduced credit risk. The effect of certifier competition is stronger for borrowers with weaker external monitoring and those generating significant revenue for their auditors. Our evidence highlights negative consequences of financial certifier competition.

.png)

This figure shows the dynamic effect of audit market competition on the cost of bank loans over the sample period of 1999 through 2004. We plot coefficient estimates using dots, with fiscal years on the x-axis. The vertical sections above and below each dot represent 90% confidence intervals.

Estimating the Value of Auditing Services for Private Firms

with Edwige Cheynel, Lisa Liu, and Lijing Tong, 2025

The Wharton School of the University of Pennsylvania Working Paper

Using voluntary audit decisions of Chinese private firms, we develop a dynamic model that considers the forward-looking behavior of both clients and audit firms. Clients simultaneously decide whether to obtain audits and increase debt, weighing the trade-offs between audit quality and fees offered by Big 10 and non-Big 10 audit firms in an oligopolistic market. Audits conducted by Big 10 firms deliver quality that is valued more than their fees, whereas the service quality of non-Big 10 firms has a similar value to the fees they charge. Audits facilitate debt financing by providing certification services while deterring clients from taking on excessive debt. Counterfactual analyses suggest that myopic clients would opt for fewer audits and that mandatory audits would impose small welfare losses on clients and would not materially alter auditor profits, with clients continuing to capture most of the gains and auditors earning limited profit. However, mandates increase Big 10 market share and deter clients from increasing debt, all while having minimal effect on audit quality. These insights can better inform policy decisions.

.png)

This table presents the distribution of audit quality (q) and audit fee (p) offered by Big 10 audit firms (solid triangles) and non-Big 10 audit firms (solid dots), respectively. The horizontal axis represents audit quality (q). The vertical axis represents audit fees (p), expressed in percentage points of total assets.

CORPORATE MISCONDUCT AND AGENCY PROBLEMS

Executive Stock Options and Systemic Risk

with Christopher Armstrong and Allison Nicoletti, 2022

Journal of Financial Economics 146 (1), 256-276

Employing a novel control function regression method that accounts for the endogenous matching of banks and executives, we find that equity portfolio vega, the sensitivity of executives’ equity portfolio value to their firms’ stock return volatility, leads to systemic risk that manifests during subsequent economic contractions but not expansions. We further find that vega encourages systemically risky policies, including maintaining lower common equity Tier 1 capital ratios, relying on more run-prone debt financing, and making more procyclical investments. Collectively, our evidence suggests that executives’ incentive compensation contracts promote systemic risk-taking through banks’ lending, investing, and financing practices.

.png)

Fig. 3. Vega and systemic risk in expansions vs. contractions. In each panel, the vertical axis on the left presents the systemic risk measure during expansions (the dashed line with diamonds) and on the right presents the systemic risk measure during contractions (the solid line with circles). The horizontal axis represents the deciles of vega. Contraction years are classified as the years 2001, 2008, and 2009. The measurement of systemic risk leads the measurement of vega by one year.

Cultural Origin and Minority Shareholder Expropriation: Historical Evidence

with Zhihui Gu and Wei Sun, 2024

Journal of Accounting Research, 62(1),181-228

Can culture explain regional differences in minority shareholder expropriation? Examining regional variation in China, we document that the influence of historical Confucian values persists, despite decades of political movements clamping down on these values, and that these values reduce minority shareholder expropriation in local public firms. The effect on minority shareholder expropriation, in part, operates through the establishment of oversight mechanisms (i.e., greater financial reporting quality and dividend payouts) that constrain expropriation. The findings have important implicationsfor understanding the origins of enduring regional differences in minority shareholder expropriation and capital market development.

.png)

Fig. 2.—Jinshi and tunneling. This figure presents tunneling as a function of the number of Jinshi over a 50-km radius around a corporate headquarters. The horizontal axis presents the quintiles of the number of Jinshi. The vertical axis (the triangle-straight line) presents tunneling, OREC1, measured as the amount of other accounts receivable that relate to transactions with controlling shareholders as a percentage of total assets.

Comply-or-Explain Regulation and Investor Protection

with Thomas Bourveau, Xingchao Gao, and Rongchen Li, 2025

Journal of Accounting and Economics 79(2-3),101756

We investigate a 2012 comply-or-explain regulation implemented by China’s Shanghai Stock Exchange. The regulation requires eligible firms to pay 30% of their current-year profits as cash dividends or explain the reasons why they do not meet this requirement through a public conference call. Using firms listed on the Shenzhen Stock Exchange as a control group, our difference-in-differences estimates suggest that firms subject to the regulation decreased tunneling, irrespective of whether they complied by paying or disclosing. Further analyses suggest that the reduction in tunneling is partially attributed to enhanced regulatory monitoring over explaining firms and the constraint on excess cash of paying firms. These findings offer novel policy insights into how a flexible comply-or-explain form of regulation can mitigate agency costs between controlling and minority shareholders in a weak institutional environment.

.png)

Fig. 3. Dynamic effects and trends on tunneling. This figure shows the dynamic treatment effects of the regulation and time trends on tunneling over the sample period of fiscal years 2009–2014. The dependent variable FinancingRPT is the amount of financing RPTs divided by total assets.